How to Link Aadhar Number With PAN Card: If you have a PAN card, it’s important to link it with your Aadhaar card by June 30, 2023. The government says it’s necessary for taxpayers to do this by the deadline. If you don’t link them on time, you’ll need to pay a late fee of Rs.1,000 when you finally do.

After June 30, 2023, if you haven’t linked your PAN with Aadhaar, your PAN card won’t work starting from July 1, 2023. So, make sure to link them in time. But even if you miss the deadline, you can still link them later by paying the required fees.

An Aadhaar card has a unique 12-digit number given to every citizen in India by the UIDAI. It’s like an ID that has your details stored in a government database, like your fingerprints and contact info.

Anyone living in India can get an Aadhaar number, no matter how old they are or what gender they are. Getting one is free. Once you enroll, your details stay in the database forever. And remember, each person can only have one Aadhaar number.

Also Read: What is PVC Aadhar Card: How to Order Online, Features, Benefits

How to check if your Aadhaar is linked to your PAN card?

To check if your Aadhaar is linked to your PAN card, follow these steps:

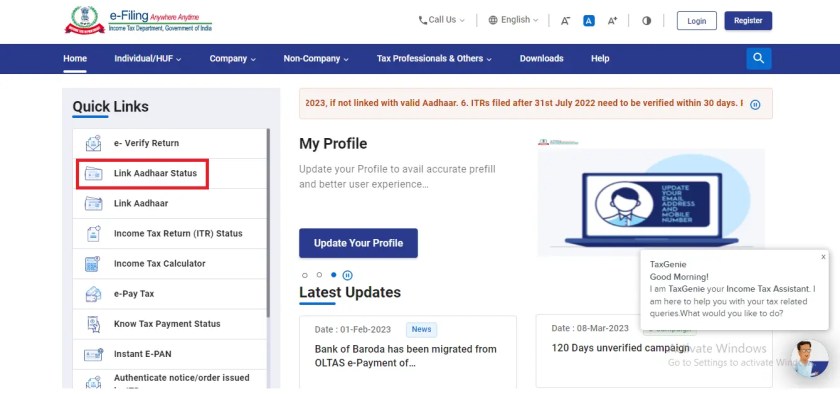

- Go to the Income Tax e-filing portal and click on “Link Aadhaar Status” from the quick links on the homepage.

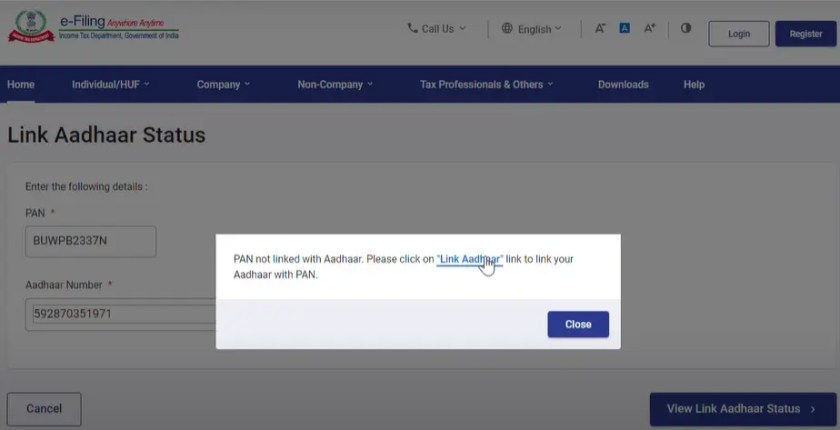

- Enter your PAN and Aadhaar numbers, then click on “View Link Aadhaar Status”.

If your PAN and Aadhaar are not linked, you’ll see a notification prompting you to link them. If they are already linked, you can proceed with your income tax filing. Remember, it’s important to link your PAN and Aadhaar to avoid any complications with your tax returns.

How to link your PAN to your Aadhaar?

To link your PAN card with your Aadhaar after the deadline, you need to follow two main steps:

- Pay the penalty.

- Submit the Aadhaar-PAN link request.

Pay the penalty.

Step 1: Go to the Income Tax e-Filing Portal.

Step 2: Click on ‘e-Pay Tax’ in the ‘Quick Links’ section.

Step 3: Enter your PAN number, confirm it, and provide your mobile number. Then, click ‘Continue’ after entering the OTP.

Step 4: You’ll be taken to the e-Pay Tax page. Click ‘Continue’ again.

Step 5: Under the ‘Income Tax’ tab, click ‘Proceed’.

Step 6: Choose the Assessment Year as ‘2025-26’, and select ‘Other Receipts (500)’ as the Type of Payment. Then, choose ‘Fee for delay in linking PAN with Aadhaar’ as the Sub-type of Payment. Click ‘Continue’.

Step 7: The penalty amount will be shown. Click ‘Continue’ again to proceed to payment.

You can pay the penalty using various methods like net banking, debit card, or through specific bank gateways listed on the portal. Once you’ve paid the penalty, make sure to link your PAN with your Aadhaar card right away.

How to Link Aadhaar Number with PAN Online or Offline:

You can connect your Aadhaar number to your PAN in two ways:

- Without Logging In: You don’t need to log in to your account for this method.

- Logging In: You’ll need to log in to your account on the Income Tax e-filing portal.

Method 1: Without Logging in to Your Account:

Step 1: Go to the Income Tax e-filing portal and click on the ‘Link Aadhaar’ tab.

Step 2: Enter your PAN and Aadhaar numbers, then click ‘Validate’.

Step 3: Enter your name (as on your Aadhaar card) and mobile number, then click ‘Link Aadhaar’.

Step 4: Enter the OTP received on your mobile and click ‘Validate’.

Step 5: Your request will be sent for validation.

If payment details aren’t verified:

- After validating PAN and Aadhaar, you might see a message saying “Payments details not found”. Click ‘Continue to Pay Through e-Pay Tax’ to pay the fee.

- Payment is necessary to submit the Aadhaar PAN link request.

- Once paid, it usually takes 30 mins to 1 hour for payment to reflect, then you can proceed with linking Aadhaar and PAN.

By following these steps, you can easily link your Aadhaar number with your PAN online.

Method 2: Logging in to Your Account:

Step 1: If you haven’t already, sign up on the Income Tax e-filing portal.

Step 2: Log in using your user ID.

Step 3: Confirm your secure access message and enter your password. Click ‘Continue’ to move forward.

Step 4: Once logged in, find and click on ‘Link Aadhaar’. You can also go to ‘My Profile’ and select ‘Link Aadhaar’ under ‘Personal Details’.

Step 5: Enter your Aadhaar number and click ‘Validate’.

Step 6: You’ll see a pop-up confirming that your Aadhaar number has been successfully linked to your PAN card.

After requesting to link your PAN with Aadhaar to activate your PAN card, which might be inactive due to not linking PAN-Aadhaar, the UIDAI will process your request. However, it may take 7 to 30 days to reactivate your PAN card from the date you submit the request.

FAQs

How long does it take to link PAN with Aadhaar?

After you submit the linking request, it might take anywhere from 7 to 30 days to link PAN with Aadhaar and reactivate your PAN card.

Is Aadhar automatically linked to PAN?

For new applicants of PAN card, the Aadhaar PAN linking is done automatically during the application stage.

Can I link Aadhaar with PAN for free?

No, the deadline for free linking was June 30, 2023. Now, there’s a penalty of Rs. 1,000 for linking Aadhaar with PAN.